XAF Currency: Central Africa’s CFA franc explained

The XAF currency is the official monetary unit used by six Central African countries.

Known more formally as the Central African CFA franc, it is one of Africa’s two CFA francs and is issued by BEAC (the Bank of Central African States). Its currency code is XAF.

Used across Cameroon, Central African Republic, Chad, Republic of the Congo, Equatorial Guinea, and Gabon, the XAF is pegged to the euro and enjoys a fixed exchange rate guaranteed by the French treasury.

This peg offers monetary stability, but also comes with controversy.

In this guide, we’ll break down everything you need to know about the Central African CFA franc: where it’s used, how it works, its colonial past, current exchange rate, and what makes it both a practical and political currency.

History of the Central African franc currency

The Central African CFA franc currency traces its origins to French colonial rule.

Initially introduced in 1945 as part of the French franc zone, it replaced the French franc in the colonies of French Equatorial Africa.

It was called “Colonies Françaises d’Afrique,” and later renamed to Communauté Financière Africaine.

The currency was established for use in French African colonies and has since been retained by their independent successors.

Though these countries gained political independence, they kept the CFA franc as a shared currency, illustrating the lasting ties with France.

This has fuelled decades-long debates about colonial currency and monetary sovereignty.

The role of the central bank

The Central African CFA franc is issued and managed by BEAC, the Banque des États de l’Afrique Centrale.

BEAC acts as the regional central bank, overseeing the monetary policy of all six central African states using the Central African CFA franc. Its headquarters are in Yaoundé, Cameroon.

It works with international institutions such as the World Bank and the International Monetary Fund and plays a crucial role in maintaining financial cooperation and monetary stability.

The BEAC ensures the convertibility of the CFA franc with the euro and manages the region’s foreign exchange reserves.

Countries using the Central African CFA franc

Six countries in Central Africa use the Central African CFA franc currency:

- Cameroon

- Central African Republic

- Chad

- Republic of the Congo

- Equatorial Guinea

- Gabon

These countries are part of the Economic and Monetary Community of Central Africa (CEMAC).

They are sometimes called the Central African states or Central African countries.

Equatorial Guinea is unique as it is the only former Spanish colony in the CFA franc zone, having joined the monetary union in 1985.

These six independent states form a monetary union fostering economic integration and stability.

As member nations of BEAC, they use a shared currency and coordinate economic policy.

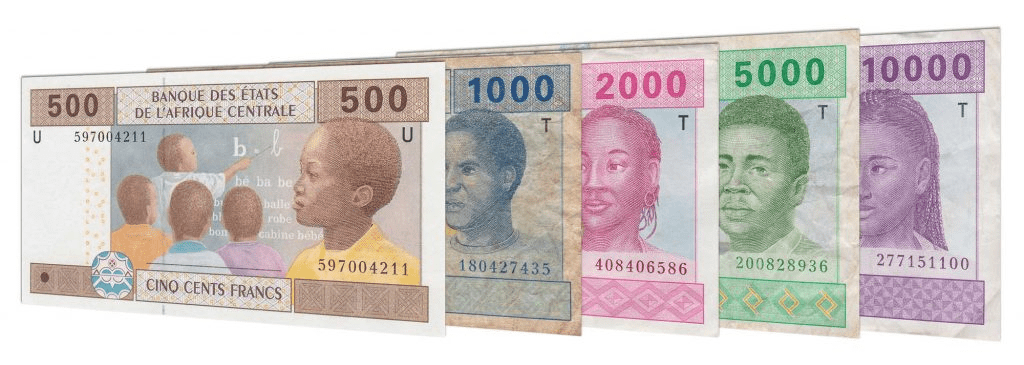

Banknotes, coins and the CFA franc symbol

The Central African CFA franc currency is available in a range of banknotes and coins, which are widely used across the six Central African CFA franc countries.

Typical central African CFA franc banknotes include denominations of 500, 1,000, 2,000, 5,000, and 10,000 francs, while central African CFA franc coins range from 1 franc up to 500 francs.

The central African CFA franc symbol is written as “F CFA.”

Both notes and coins are issued by BEAC and feature designs that reflect regional industries, wildlife, and cultural heritage relevant to Central Africa currency users.

The XAF shares the same value as the West African CFA franc (XOF), but the two operate in separate monetary unions.

As such, XAF coins and banknotes are not interchangeable with those used in West Africa.

How the Central African CFA franc is pegged to the euro

The Central African CFA franc has been pegged to the euro since 1999, following its earlier peg to the French franc. The current fixed exchange rate is 1 euro to 655.957 XAF.

This peg is guaranteed by the French treasury, providing a sense of monetary stability.

However, it also limits flexibility.

The CFA franc’s peg to the euro is central to its operation, influencing inflation, economic growth, and foreign investment.

The European Central Bank, the French government and BEAC all have roles in maintaining this fixed exchange rate.

However, some argue that pegging to the euro restricts local economic development and locks member countries into an outdated post-colonial relationship.

The CFA franc zone and economic cooperation

The Central African CFA franc is part of the wider CFA franc zone, which includes both the XAF and the West African CFA franc (XOF).

The CFA franc zone operates as a network of two monetary unions:

- The Economic and Monetary Community of Central Africa (CEMAC)

- The West African Economic and Monetary Union (WAEMU)

This structure allows for shared monetary policy and common currencies.

It also supports financial cooperation, economic and monetary union, and reduced exchange rate volatility among member countries.

However, critics claim that it perpetuates French monetary imperialism.

XAF vs West African CFA franc: Two currencies, one origin

The West African CFA franc (XOF) is used by eight West African countries, including Ivory Coast, Burkina Faso, and Senegal.

It is issued by a different central bank — the BCEAO (Central Bank of West African States).

Despite having the same value and peg to the euro, the XAF and XOF are not interchangeable.

They are two separate currencies managed by two different institutions, though the French treasury ultimately backs both.

This dual system illustrates the legacy of colonial-era currency policy and the ongoing efforts for African financial community integration.

Why is it called the CFA franc?

The acronym CFA originally stood for Colonies Françaises d’Afrique.

Over time, it was renamed to Communauté Financière Africaine for West Africa, and Coopération Financère en Afrique Centrale for Central Africa.

In practice, both are commonly referred to as the CFA franc.

Despite the name changes, the currency continues to symbolise both financial unity and the complexities of independence and post-colonial identity.

Post-colonial legacy

The Central African CFA franc has sparked ongoing debates about monetary independence.

While it offers a common currency and macroeconomic stability, it also represents a colonial legacy.

Many African economists argue that the continued use of the CFA franc hinders economic development and delays full sovereignty.

Yet others highlight its benefits: low inflation, currency stability, and international investor confidence.

The question remains whether countries will eventually transition away from the CFA franc towards more autonomous monetary frameworks or continue to reform it from within.

How to buy Central African CFA francs

Buying Central African CFA francs with Manor FX is quick, secure, and stress-free.

Whether you’re heading to Cameroon, Chad, or the Republic of the Congo, we make it easy to get the currency you need without the hassle.

Here’s how to order:

1. Start your order

Choose XAF (Central African CFA franc) from our list of currencies.

You can enter how many francs you’d like or how much you want to spend in pounds.

2. Choose delivery or collection

Select either secure, insured home delivery or collection from our London counter.

Both options are designed to work around your plans.

3. Check your live rate

We’ll show you a fixed Central African Franc exchange rate and a full breakdown of costs, so you know exactly how much you’ll receive before committing.

4. Fill in your details

Add your name, contact info, and delivery address if needed. This helps us process your order securely and efficiently.

5. Pick your delivery or collection date

Need your francs fast? Order before 2 p.m. on a weekday for next-working-day delivery.

6. Pay securely

Pay in advance by bank transfer or by card. For in-person collection, you can also pay in cash.

7. Finalise your order

Accept our terms and confirm your order. You’ll get an instant email confirmation with a summary and payment instructions.

It’s that simple.

When you need Central African currency, Manor FX offers excellent rates, expert support, and a smooth, reliable experience from start to finish.

Takeaways

Understanding the Central African franc helps you navigate expenses, rates, and value when travelling to Central Africa.

Its peg to the euro offers predictability, and its shared use across six countries makes it convenient.

At Manor FX, we offer the best rates on Central African CFA franc and other African currencies – online or at our travel money shop in Datchet.

FAQs

Which country uses the CFA franc?

Countries using the Central African CFA franc include Cameroon, Central African Republic, Chad, the Republic of the Congo, Equatorial Guinea, and Gabon.

A different set of countries, including the Ivory Coast and Burkina Faso, use the West African CFA franc.

What does CFA stand for in currency?

CFA originally stood for Colonies Françaises d’Afrique, but now stands for Communauté Financière Africaine (African Financial Community).

How much is $1 US dollar in CFA francs?

As of today (11th June 2025), 1 US dollar is worth around 600 XAF, but this can fluctuate slightly. For the most accurate rates, check a live conversion chart.