Get

Get

Indian Rupees Fast!

- Free home delivery over £750

- with Royal Mail Special Delivery 1pm

- Better rates than the banks

“Easy process from start to finish. Competitive prices and excellent customer support. Would highly recommend and will use again.”

Emma Thompson

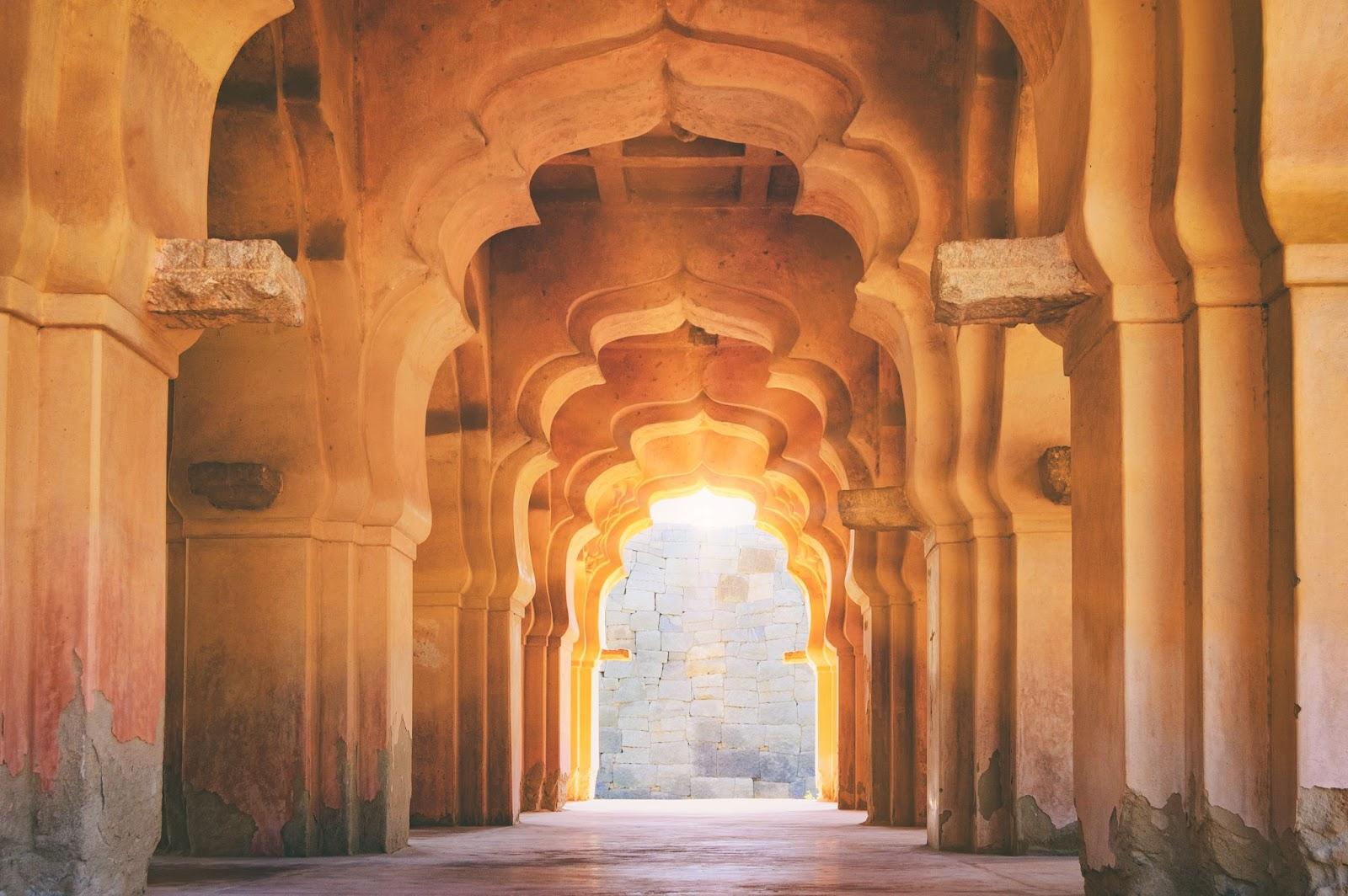

Travelling to India?

Get the best Indian rupee exchange rate online

Prepare for your Indian adventure and buy Indian rupees with Manor FX.

Get the best GBP to Indian rupee exchange rates online, and you’ll have more Indian rupees to spend on your fantastic adventure.

You can opt for secure home delivery or collect your travel money from our bureau near Heathrow.

Our quick, convenient online ordering system simplifies getting your travel money.

Convert pounds to Indian rupees with Manor FX.

Indian rupee travel money

Let’s get you ready for India with valuable information on cash and card payments in India!

Where can you get Indian rupees?

You can get Indian rupees at Manor FX.

Unlike major currencies, the Indian Rupee isn’t widely available.

You won’t find it at the post office or from banks.

We offer the best Indian rupee exchange rate and free home delivery for travel money orders over £750.

Check our exchange rates and save money when you convert British pounds to Indian rupees today!

Avoid hidden fees and excessive airport exchange charges.

We also provide a money buy-back service. When you return, you can convert your Indian rupees back to GBP at the best Indian rupee buying rate.

Can I buy Indian rupees in the UK?

Yes, you can buy Indian rupees online from currency providers like us!

We’re the best place to buy Indian rupee currency. We have the best exchange rate for pound sterling to Indian rupees online.

Why not avoid costly rates at the airport and benefit from having your spending money delivered right to your door before you go?

If you’re near Heathrow, you can also visit our bureau for the same outstanding UK pound to Indian rupee exchange rates.

Can I buy rupees before I go to India?

Absolutely, and it’s a brilliant idea! We have the best INR rates, so exchange your British pounds to rupees now.

Should I get rupees before I go to India?

Yes, exchanging some British pounds before you travel to India is a good idea.

This way, you’ll have local currency in your wallet ready for immediate expenses like transport, meals, and small purchases upon arrival.

Manor FX has the best British pound to Indian rupee rate.

We’ll also help you take care of your Indian rupee to British pound conversion if you’ve got banknotes leftover on your return.

What is the best currency to bring to India?

The Indian rupee (INR) is your best option when travelling to India. It’s the official currency and widely used.

Using US dollars might result in less favourable exchange rates. Pay in INR for smooth and cost-effective travel.

Remember to convert Indian rupees to English pounds with Manor FX when you return.

Can I use US dollars in India?

The US dollar is not widely accepted for transactions in India.

Can I use my debit card in India?

Yes, you can use your debit and credit cards (like Mastercard and Visa) in India, especially in cities and tourist areas.

However, using money for smaller purchases helps avoid card payment fees and ensures you can still pay in places that don’t accept cards.

Should I use cash in India?

Carrying cash in India is crucial for various transactions. We strongly advise having the Indian rupee (INR) on hand during your journey.

Indian rupee cash is handy for making purchases at local stores, dealing with street vendors and covering taxi fares.

You’ll also need money for public transportation, tips, exploring markets, and dining at local eateries.

You can convert any Indian rupees to UK pounds upon returning to the UK.

Buy Indian rupees now

Is it better to use cash or credit card in India?

Having some money with you as cash is a good idea when you’re in India. Many places in Indian cities don’t accept credit and debit cards.

You may lose out on the Indian rupee exchange rate when you use a card to make payments.

Vendors such as taxi drivers, street vendors, and local tour guides often prefer cash for transactions.

Have leftover currency from your trip? Convert Indian rupees to GBP with Manor FX when you return.

How much cash should I bring to India?

India offers travellers a wide range of experiences. Your expenses will vary depending on where and when you visit.

You’ll find that bustling urban hubs like Delhi and Mumbai often have a higher price tag.

Venturing into enchanting, off-the-beaten-path locales like Jaipur or Udaipur can be a budget-friendly alternative.

Note: Prices may rise significantly during major festivals and events. Plan ahead to navigate any potential increases in accommodation and activity costs.

How can I avoid ATM fees in India?

Avoid ATM fees in India with these suggestions:

- For lower or no fees, opt for ATMs from major Indian banks like the State Bank of India, ICICI Bank, and HDFC Bank.

- Withdraw larger amounts less often to minimise the frequency of ATM visits and fees.

- Contact your home bank before your trip. Inquire about partnerships with Indian banks offering their customers free ATM usage.

- Change currency before your trip with Manor FX to avoid excessive ATM usage. We offer the best foreign exchange rates and doorstep delivery.

Is India cheap for tourists?

Yes, India is generally a cheap country for tourists.

Travel, food, and accommodation costs are low, so you can save money while enjoying great value throughout your trip.

How does tipping work in India?

Tipping in India is common.

- A 10% tip is typical at restaurants, though some may include a service charge; always check the bill.

- In bars, rounding up or leaving small change is appreciated. For taxis, rounding up the fare is the norm.

- Tipping the guide is polite on guided tours, and in hotels, tips range from 100 to 500 rupees for staff services.

Is India safe for tourists?

India is generally safe for tourists, especially in popular destinations.

Like any country, stay aware of your surroundings, avoid isolated areas at night, and follow local advice.

Buy Indian rupees now

Indian rupee currency

The Indian rupee is the official currency of India, regulated by the Reserve Bank of India to ensure security and stability.

It replaced older state currencies and reflects India’s rich history, culture, and growing role in the world economy.

Indian banknotes

Indian banknotes are issued in denominations of 10, 20, 50, 100, 500, and 2,000 rupees.

Each note highlights key figures and landmarks from India’s past. Always check for security features to avoid counterfeit Indian rupees.

Indian rupee coins

Indian coins range from 1 to 10 rupees and display national symbols like the ₹ sign or Ashoka Pillar.

Older coins were once minted in silver or gold, especially during earlier Indian history.

Today, coins are made from base metals, and paise coins, introduced during decimalisation in 1957, are now rarely seen.

Always check for damage or authenticity when handling coins.

Indian currency import and export regulations

Import

You can bring up to 25,000 Indian rupees (INR) in cash into India.

There’s no limit on foreign currency, but amounts over USD 10,000 (or equivalent) must be declared to Indian customs.

Export

You cannot take Indian rupees out of India. However, you may carry foreign currency and coins up to the amount declared on arrival.

Always keep receipts for currency exchange in case proof is needed when you leave the country.

Order Indian rupees online – get the best indian rupee rate

Exchange pounds to Indian rupees today through Manor FX. Get the best GBP to INR exchange rate today.

Have holiday money delivered swiftly and securely to your home or office with Royal Mail Special Delivery Guaranteed®.

You can also buy INR online and click and collect your currency from our Manor FX travel money shop near Heathrow.

Click here to convert GBP into INR now.

Sell back Indian rupees

Need to turn your Indian rupees to pound sterling?

Click on the ‘sell currency’ option at the top of the page and specify ‘Indian rupee (INR)’.

Manor FX offers the best INR to GBP rate for your unused travel money. Ensure you get the most value from your currency conversion.

FAQs

How many Indian rupees to a pound?

As of 19th September 2024, 1 British pound (GBP) equals approximately 111.13 Indian Rupees (INR).

Keep in mind that exchange rates can fluctuate. It is always a good idea to check the current rate before exchanging currency.

Do you need a visa to go to India?

Yes, most travellers need a visa to enter India. UK citizens can apply for an e-Visa online before travel.

What vaccinations are required for India?

Recommended vaccinations for India include hepatitis A, typhoid, and tetanus.

Depending on your travel plans, you may also need hepatitis B, rabies, cholera, or Japanese encephalitis.

Always check with your GP or travel clinic before travelling.

What is the best time to travel to India?

The best time to travel to India is between October and March, when the weather is cooler and drier, making it ideal for sightseeing and exploring.

Don’t forget to get your travel money sorted in advance!

Is GBP getting stronger against INR?

The strength of GBP against INR changes daily. Recently, GBP has shown some strength, but it’s best to check live exchange rates for the latest trend.

What is the best exchange rate for Indian rupees?

The best exchange rate for Indian rupees is usually close to the mid-market rate (sometimes known as the interbank rate).

Compare providers and avoid high fees to get the best exchange rate.

Feel the Trustpilot love

Great competitive rates & friendly & helpful staff. Easy to order online & collect in person or delivery.

Great, fast and reliable service would certainly use again for my travel needs, as the rates are the best around!

This amazing company have gone above and beyond in getting a large amount of a rare currency across the pond to Ireland.

Great rates and really responsive, friendly customer support, will definitely be using Manor FX again.

Manor FX gave me a better rate than my bank with great customer service, I highly recommend them.

Family run business that’s always super helpful. Manor FX’s rates are always really good as well!

Get

Get

Indian Rupees Fast!

- Free home delivery over £750

- with Royal Mail Special Delivery 1pm

- Better rates than the banks