What is a closed currency? Will it affect your travel plans?

Understanding closed currencies

This is crucial as a traveller, especially when planning a trip to countries with closed currencies.

These currencies, not freely exchanged on the global market, present unique challenges and opportunities for your travel experience.

First, let’s explore what a closed currency means for your trip.

What is a closed currency?

A closed currency is a type of currency that is not freely tradable outside of its country of origin. You can’t easily exchange it in other countries.

Visiting a closed currency country often means you can’t buy your travel money before arriving. And you might face restrictions on how much you can exchange.

This calls for a different approach to budgeting and spending. Make sure to research the specific rules of the country you’re visiting.

But there’s a silver lining. In countries with closed currency, you might find that your money goes further. Because of controlled exchange rates and local economic conditions.

This can be a boon for savvy travellers looking for unique experiences without the hefty price tag.

So, what should you keep in mind?

Always check the latest regulations and exchange rules for the country you’re visiting. Be prepared for scenarios like limited access to ATMs, high ATM fees or credit card usage restrictions.

And remember, understanding closed currencies and their implications can turn a potential challenge into an advantage for your travels.

Are closed currencies available in the UK?

Closed currencies are not typically available in the UK

These currencies are restricted by their countries of origin and can’t be freely exchanged or bought outside of those countries.

For travellers from the UK, planning to visit a country with a closed currency typically has implications. It often means waiting to exchange money upon arrival in that country rather than beforehand in the UK.

Where can I buy closed currencies in the UK?

In the UK, buying closed currencies before you travel is hard

Closed currencies are restricted and generally unavailable for exchange on the international market.

This means that under normal circumstances, you would have to wait to exchange your money upon arrival in a country that uses the closed currency.

Buy closed currency

How to get closed currencies for your travels?

Get your closed currency travel money for your next trip with Manor FX

Getting your hands on a closed currency before your journey can feel like a bit of a treasure hunt.

Since you can’t typically buy these currencies outside their home country, it requires a bit of know-how and planning…

But we sell more than 160 global currencies – including most minor, exotic and hard-to-buy currencies.

You’ve come to the right place if you need unusual currency or travel money for a closed currency country.

How can we source and sell hard-to-find currencies other bureau de changes can not?

We have several ways of sourcing currencies that other exchanges can’t. Most involve our sister company, Leftover Currency.

- Leftover Currency helps individuals convert any leftover travel money and old currency into cash. So, customers send in their old foreign currency that way.

- Leftover Currency also works with TUI, Virgin flights and various airports to process donations of leftover and unused foreign currency. Which provides a steady source of a wide range of currencies.

- Charity partnerships and cooperation with schools are other ways Leftover Currency sources rare and exotic currency. In 2022, Leftover Currency raised over £1 million for charities and good causes!

Any out-of-circulation currencies acquired are taken back to their country of origin. At the same time, we’ll buy the current currency and bring it back to sell to you.

Which countries have closed currencies?

Here is a list of list of closed currencies (as of 2023).

- Bahamas. Bahamian dollar (BSD)

- Armenia. Armenian dram (AMD)

- Albania. Albanian lek (ALL)

- Cambodia. Cambodian riel (KHR)

- Cameroon. Central African CFA franc (XAF)

- Cuba. Cuban peso (CUP)

- Ethiopia. Ethiopian birr (ETB)

- Georgia. Georgian lari (GEL)

- Ghana. Ghanaian cedi (GHS)

- Iran. Iranian rial (IRR)

- Laos. Lao kip (LAK)

- India – Indian rupee (INR)

- Myanmar. Myanmar kyat (MMK)

- Libya. Libyan dinar (LYD)

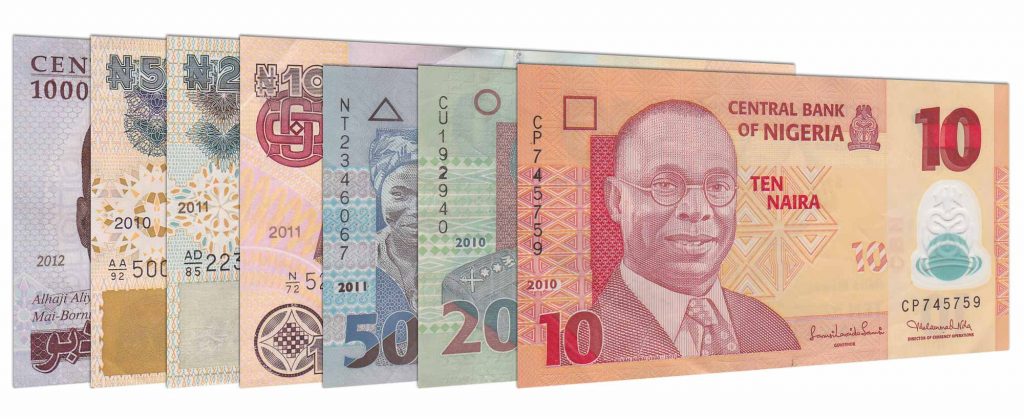

- Nigeria. Nigerian naira (NGN)

- North Korea. North Korean won (KPW)

- Nepal. Nepalese rupee (NPR)

- Samoa. Samoan tala (WST)

- Sri Lanka. Sri Lankan rupee (LKR)

- Sudan. Sudanese pound (SDG)

- Tunisia. Tunisian dinar (TND)

- Ukraine. Ukrainian hryvnia (UAH)

- Uzbekistan. Uzbekistani som (UZS)

- Zimbabwe. Zimbabwean dollar (ZWL)

- Venezuela. Venezuelan bolívar (VES)

Each country from the closed currency list has its own regulations.

The impact of closed currencies on your travel plans

Travelling to a country with a closed currency can be an adventure in itself. But what exactly does it mean for you as a traveller?

You need to plan ahead

Getting your hands on a closed currency isn’t as straightforward as popping into a bureau de change in the airport or withdrawing from an ATM.

Buy your currency through Manor FX to ensure you’ve got local currency to spend on arrival.

- You can click and collect your travel money from our bureau de change near Heathrow,

- Or, get your travel money delivered to your home or office.

Budgeting is crucial

You must consider how much local currency you’ll need in these destinations. Being cash-savvy is critical.

Plan how much cash you’ll need for the duration of your stay. Keep in mind daily expenses, accommodation, transport, and a little extra for emergencies or unplanned adventures.

Running out of cash can be more than just an inconvenience, as finding places to exchange more might not be easy.

Credit cards and digital payments

Be aware that debit or credit card payments may not be as widely accepted as you’re used to.

But here’s the exciting part. Closed currencies can sometimes lead to unexpected benefits.

Think favourable exchange rates and unique purchasing power. It can turn your trip into a more affordable experience, allowing you to explore and enjoy more for less.

Navigating through the quirks of closed currencies adds an extra layer to your travel experience. Be prepared, adaptable, and ready to embrace the unique.

Buy closed currency

Travel tips to maximise your experience in closed currency countries

Travelling to countries with closed currencies can be an exciting adventure. But it does require some extra planning and preparation. To make your trip smoother and more enjoyable, consider these travel tips:

- Research currency restrictions. Before you go, research the specific currency restrictions of the country you’re visiting. Understand how much local currency you can legally bring in or take out of the country. Being aware of these limits can help you avoid any potential issues at customs.

- Plan ahead. Since currency exchange options may be limited, plan your financial needs beforehand. Ensure you have enough cash for your entire stay, and consider what you’ll do in case you run out.

- Exchange some currency in advance. Use Manor FX to get hold of your currency before you travel. If it’s not possible to get the exact currency you need, consider an in-between measure. Before travelling, exchange money for widely accepted currencies like US dollars or euros. These can serve as a backup until you can exchange for the local currency on arrival.

- Use official exchange services. When exchanging your money in a closed currency country, always use official exchange services like banks or authorised exchange offices. Avoid unofficial or black-market exchanges, as they can be risky and potentially illegal.

- Budget smartly. Since accessing money can be different in these countries, planning your budget is key. Estimate your daily expenses for food, transport, activities, and a little extra for those spontaneous adventures.

- Carry sufficient cash. Credit cards and digital payments may have limited acceptance in closed-currency countries. So, carrying enough local currency in cash is essential. Plan your daily expenses and add a buffer for unexpected costs.

- Learn about local prices. Get a sense of local prices and the cost of living in the country you’re visiting. This can help you budget more effectively and prevent overspending.

- Embrace local markets. Closed currency countries often have vibrant local markets where you can find unique products and experiences. Explore these markets to immerse yourself in the local culture and enjoy reasonably priced goods. Engaging with the local economy enhances your travel experience and supports the community.

- Stay informed. Keep an eye on travel advisories and any changes in currency regulations. Closed currency countries may adapt their rules, so staying informed can help you adjust your plans accordingly.

- Be flexible. Closed currency countries can sometimes have unexpected challenges. Be flexible with your travel plans and embrace the uniqueness of the experience.

- Enjoy the authenticity. Lastly, embrace the authenticity of your travel experience. Closed currency countries often offer a glimpse into a world less influenced by global tourism trends. You’ll discover hidden gems and create lasting memories.

By following these travel tips, you can navigate the intricacies of closed currencies and make the most of your journey.

Remember that every destination has its own charm and surprises, and closed-currency countries are no exception.

Why use Manor FX?

Convenience at your fingertips

It’s super convenient and saves you precious time and effort. No more queues at exchange offices or ATMs!

Competitive rates like no other

Get a better deal than what you would find at airports, local exchange bureaus, or banks.

Unmatched safety and security

Opt for home delivery. You don’t need to risk carrying cash to and from a currency exchange provider. Plus, it’s insured for your peace of mind.

A world of choices

With us, the world is your oyster. Pick from a diverse range of currencies, including those hard-to-get closed and partially restricted ones others can’t provide.

Avoid unnecessary fees

Say goodbye to those pesky fees that are all too common at airport exchanges or currency kiosks.

Budgeting made easy

Plan and budget like a pro for your travels. Knowing exactly how much foreign currency you have before your trip helps manage your travel expenses.

24/7 online ordering

Our online ordering system is available around the clock. This means you can exchange your British pounds to travel money whenever it’s convenient for you.

Takeaways:

As we’ve explored, navigating the world of closed currencies adds a fascinating layer to your travel adventures.

Whether you’re a seasoned globetrotter or planning a once-in-a-lifetime trip, understanding these unique monetary systems is vital to a seamless and enriching experience.

Travelling to countries with closed currencies is about more than managing your money differently. You can step into a different world with its own rules and rhythms. It challenges you to plan more thoughtfully and engage more deeply with the places you visit.

From the bustling local markets that offer a glimpse into the heart of a culture to the unexpected joys of discovering how far your money can go in these economies. Each trip is a chance to learn and grow.

We hope this guide has shed light on the intriguing world of closed currencies and equipped you with the knowledge to tackle any monetary challenges on your travels.

Here’s to many more adventures!

FAQs

What is the purpose of a closed currency?

In simpler terms, a closed currency’s purpose is to protect a country’s economy and control its financial affairs.

What are partially convertible currencies?

Partially convertible currencies are a unique category of currencies that fall somewhere between fully convertible and closed currencies. Unlike fully convertible currencies, which can be freely traded and exchanged on the global market, and closed currencies, which are tightly controlled and restricted, partially convertible currencies have a set of limitations and restrictions.

Which countries have partially convertible currencies?

Here’s a list of currencies that fall into the category of partially convertible or restricted currencies:

- Angola. Angolan kwanza (AOA)

- Argentina. Argentine peso (ARS)

- Barbados. Barbadian dollar (BBD)

- Belize. Belize dollar (BZD)

- Bolivia. Bolivian boliviano (BOB)

- Brazil. Brazilian real (BRL)

- Chile. Chilean peso (CLP)

- China. Chinese yuan/renminbi (CNY)

- Egypt. Egyptian pound (EGP)

- Fiji. Fijian dollar (FJD)

- Indonesia. Indonesian rupiah (IDR)

- Malaysia. Malaysian ringgit (MYR)

- Mauritius. Mauritian rupee (MUR)

- Morocco. Moroccan dirham (MAD)

- Namibia. Namibian dollar (NAD)

- Pakistan. Pakistani rupee (PKR)

- Papua New Guinea. Papua New Guinean kina (PGK)

- The Philippines. Philippine peso (PHP)

- Russia. Russian ruble (RUB)

- South Africa. South African rand (ZAR)

Why is MAD a closed currency?

The currency of Morocco, the Moroccan dirham (MAD), is considered a partially convertible currency, which means it’s not entirely open for free exchange like some other currencies. The reason behind this lies in Morocco’s economic policies and goals.

Morocco wants to control its currency’s value and stability. By limiting how much MAD can be freely exchanged outside of Morocco, the government can manage its economy better. This helps prevent sudden changes in the currency’s value, which could disrupt trade and the overall financial system.

Is Egypt a closed currency?

No, Egypt’s currency is not considered a closed currency. The Egyptian pound (EGP) is a partially convertible currency, which means there are fewer restrictions on its exchange than closed currencies. Travellers can generally exchange Egyptian pounds in international currency markets and use them for transactions abroad, although there may be some limitations.